Finance is a term for matters regarding the management, creation, and study of money and investments. It involves the use of credit and debt, securities, and investments to finance current projects using future income flows. Due to this temporal aspect, finance is closely linked to the time value of money, interest rates, and other related topics.

Personal finance is about meeting your personal financial goals. These goals could be anything—having enough for short-term financial needs, planning for retirement, or saving for your child’s college education.

MONEY

Money, also sometimes called currency, can be defined as anything that people use to buy goods and services. Money is what many people receive for selling their own goods or services.

GETTING STARTED

FINANCIAL INDEPENDENCE

FEW STEPS TO GETTING READY

1. DEVELOP AN IDEA

They say that without a plan, you are planning to fail. Success is first achieved when you plan. Someone might ask, "How do I plan without an idea?" In simple terms, when you do not have an idea yet, it is acceptable to copy what already exists and improve it to set yourself apart.

Most individuals believe that an idea must always be new. However, I disagree. They say geniuses create new ideas, but clever ones copy and improve them. This is how life works. It is good practice to consider how your idea will survive if brought to life. Just as a couple would plan to bring a child into this world, they first consider all the possible challenges and benefits. This leads to planning. How do you get ideas?

- Consultation

- Exposure to information

- Internet research

2. PLANNING

This is the critical part of success. With a plan, you have already succeeded. Without using complex terms, we can simplify it by saying that aligning the way you execute your ideas is essential. This is simply done through documentation and setting goals.

3. BUDGET

This is extremely important. The budget will guide how you will spend your money, showing you how to manage your generated income without spending what you don’t have.

How to create a budget:

General Budget

| Category |

Details |

Amount |

| Income |

Salary, Bonuses |

k5,000 |

| Expenses |

Rent, Utilities, Groceries |

k3,000 |

| Savings |

Emergency Fund, Retirement |

k1,000 |

| Investments |

Stocks, Bonds |

k500 |

| Miscellaneous |

Entertainment, Dining Out |

k500 |

Important Aspects of a Budget

When creating a budget, it is crucial to:

- Identify all sources of income and expenses

- Allocate funds for savings and investments

- Monitor and adjust the budget regularly

Implementation

To implement the budget:

- Track spending using apps or spreadsheets

- Review and adjust monthly

- Set financial goals and prioritize accordingly

THE BREAKTHROUGH

By considering the steps mentioned above, you have found a breaking point. It’s easy; all it requires is commitment, discipline, and consistency. More will be discussed later.

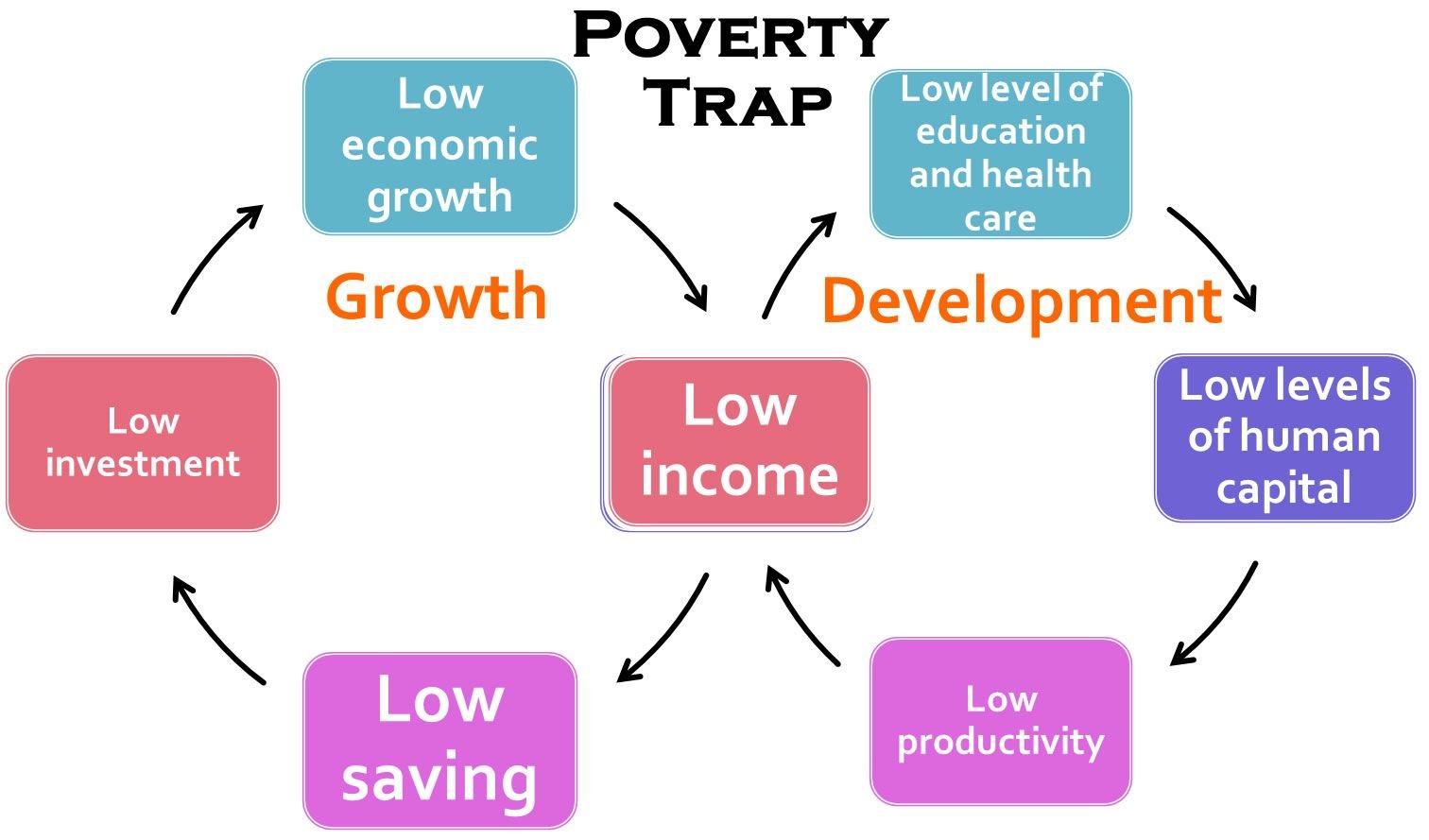

RESOLVING THE FINANCIAL CHALLENGES

Financial aptitude is what you do with the money you earn. Earning money is the first step. To be wealthy, you need the financial aptitude to know what to do with that money.

Investing in financial assets is the best way to use your money and let it work for you. Buy stocks, bonds, rental properties, and other income-generating financial assets.

Financial literacy will help you gain financial intelligence and learn how to have your money earn more money.

Our single most valuable asset is our mind, not our material possessions, such as a house or car. Money or anything else.

Debt distracts us, limits us, and causes undue stress and anxiety. It’s essential to recognize the importance of being wise stewards.

Recognize that true financial freedom comes from living within our means and avoiding the burden of debt.

- Avoid debts: By living debt-free, we position ourselves to experience the peace and abundance that come from trusting in God's provision.

- Discipline: It requires discipline, sacrifice, and a willingness to prioritize our values over passing whims. Strive not to be slaves to debt.

If you have a keen mind and train it well to develop a strong financial IQ, you can gather wealth and become rich. It’s your mindset and values that need to change.

Change how you think about money, including how to earn and manage it, to change your life.

“In the real world, the smartest people are those who make mistakes and learn. In school, the smartest people don’t make mistakes.”

“The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth in what seems to be an instant.”

“Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.”

“It’s not what you say out loud that determines your life. It’s what you whisper to yourself that has the most power.”

“Workers work hard enough to not be fired, and owners pay just enough so that workers won’t quit.”

Taxes

Taxes are mandatory financial charges or levies imposed by a government on individuals, businesses, and other entities. They are collected to fund various public expenditures such as infrastructure, education, healthcare, and national defense. Taxes can take various forms, including income tax, sales tax, property tax, and corporate tax, among others.

IMPORTANCE OF TAXES

- Revenue for Government: Taxes are the primary source of revenue for governments.

- Public Services and Welfare: Taxes finance critical public services that contribute to the well-being and quality of life of citizens.

- Economic Stability and Growth: Through fiscal policies, governments use taxes to regulate the economy.

- Public Health and Safety: Taxes support public health initiatives, including disease prevention programs.

"The Richest Man in Babylon" by George S. Clason is a fascinating lesson in personal finance written in short, easy-to-digest stories. First published in 1926, the classic parable style and timeless concepts about how to build wealth continue to provide value as if it was written today.

The book is set in ancient Babylon and follows the story of Arkad, the richest man in all of Babylon, imparting his wisdom to a younger man, Bansir, who wishes to become wealthy.

Inspirations from "Rich Dad Poor Dad" and "Cashflow Quadrant" by Robert Kiyosaki

"Rich Dad Poor Dad"

In "Rich Dad Poor Dad", Robert Kiyosaki shares the financial wisdom he learned from his two fathers: his biological father (Poor Dad) and the father of his best friend (Rich Dad). Key inspirations include:

- Financial Education: Understanding money and how it works is crucial. Rich Dad emphasized the importance of financial literacy to achieve financial success.

- Assets vs. Liabilities: Kiyosaki explains the difference between assets (things that put money in your pocket) and liabilities (things that take money out of your pocket). Focusing on acquiring assets is key to building wealth.

- Mindset Shift: The book encourages readers to think like entrepreneurs and investors rather than employees. This shift in mindset can lead to greater financial independence.

"Cashflow Quadrant"

In "Cashflow Quadrant", Kiyosaki introduces the concept of the four quadrants: Employee (E), Self-Employed (S), Business Owner (B), and Investor (I). Key inspirations include:

- Quadrant Classification: Understanding which quadrant you earn your income from can help you identify your financial habits and future goals.

- Moving to the Right Side: Kiyosaki advocates for moving from the E and S quadrants to the B and I quadrants, where true financial freedom is achieved through owning businesses and investments.

- Building Passive Income: The book emphasizes the importance of generating passive income through investments and business ownership, allowing you to achieve financial freedom without constant active work.

Both "Rich Dad Poor Dad" and "Cashflow Quadrant" offer invaluable insights into financial education, the importance of mindset, and practical strategies for achieving financial independence. Robert Kiyosaki's teachings inspire readers to take control of their financial future and strive for lasting wealth.